As we step into 2025, the world of cryptocurrency continues to evolve at a blistering pace, transforming digital assets from niche curiosities into mainstream financial powerhouses. Bitcoin, the pioneering cryptocurrency, stands at the forefront, its value and influence soaring higher than ever. For savvy investors eyeing profitability, selecting the right Bitcoin mining machine isn’t just a technical decision—it’s a strategic blueprint for success. With advancements in blockchain technology and increasing adoption, mining Bitcoin offers a lucrative avenue, but only if you choose equipment that’s efficient, reliable, and future-proof. Imagine harnessing the power of cutting-edge hardware to turn raw computational energy into cold, hard cash. This guide dives deep into the essentials, blending insights on Bitcoin’s ecosystem with practical advice on mining machines, all while touching on related cryptos like Ethereum and Dogecoin to broaden your perspective.

In the realm of Bitcoin mining, the heart of profitability lies in understanding the core components of a high-performance mining machine. These devices, often referred to as mining rigs, are sophisticated assemblies of processors, cooling systems, and power supplies designed to solve complex cryptographic puzzles. By 2025, expect machines with hash rates exceeding 200 terahashes per second, a quantum leap from today’s standards, driven by innovations in ASIC technology. But it’s not just about speed; energy efficiency is king. A top-tier miner will consume less electricity while delivering maximum output, potentially slashing operational costs by up to 50%. Picture this: a sleek, humming rig in your setup, quietly generating rewards in Bitcoin, all while being eco-friendlier than older models. Diversifying into other currencies like Ethereum, which has transitioned to a proof-of-stake model, or the whimsical Dogecoin, still reliant on proof-of-work, adds layers of strategy, as miners must adapt their rigs for varying algorithms and network demands.

Looking ahead to 2025, the landscape of cryptocurrency mining is poised for seismic shifts, influenced by regulatory changes, market volatility, and technological breakthroughs. Bitcoin’s halving events, which reduce mining rewards every four years, will make efficiency even more critical, pushing investors toward machines that can weather economic storms. Enter the era of quantum-resistant mining rigs, equipped with enhanced security features to fend off potential threats from advancing quantum computing. Meanwhile, Ethereum’s evolution post-Merge emphasizes sustainability, potentially drawing miners away from energy-intensive operations, yet Bitcoin remains a staple for those chasing stability and high returns. Dogecoin, with its community-driven ethos, might surprise with surges in popularity, reminding us that profitability isn’t solely about hardware—it’s about timing the market and diversifying across assets like BTC, ETH, and DOG.

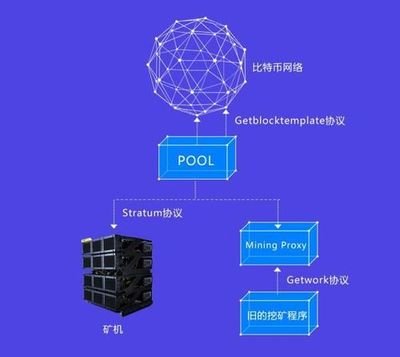

One cannot overlook the role of mining farms in this ecosystem—vast warehouses filled with rows of miners, optimized for 24/7 operation. These facilities, often called mining farms, provide the infrastructure that individual investors might lack, including robust cooling systems and reliable power sources. For those in the business of selling or hosting mining machines, partnering with a top-tier farm can amplify returns. Hosting services allow you to deploy your Bitcoin miners without the hassle of maintenance, letting experts handle the grunt work while you reap the rewards. This setup is particularly advantageous for newcomers to cryptocurrencies, bridging the gap between hobbyist mining rigs and professional-scale operations. By integrating elements from Ethereum’s decentralized ethos or Dogecoin’s fun, accessible vibe, farms can cater to a broader audience, making mining more inclusive and profitable across the board.

Burst onto the scene with a miner’s mindset: evaluate not just the upfront cost of a machine, but its long-term viability in a fluctuating market. A smart investor in 2025 will scrutinize factors like noise levels, durability, and compatibility with emerging technologies, ensuring their rig doesn’t become obsolete overnight. For instance, machines optimized for Bitcoin can often be repurposed for altcoins like ETH or DOG, adding versatility to your investment portfolio. The thrill lies in the unpredictability— one day you’re mining during a Bitcoin bull run, the next you’re adapting to a Dogecoin meme-fueled rally. To maximize gains, consider metrics such as ROI calculations, which factor in electricity prices, hardware costs, and potential rewards, painting a vivid picture of future earnings.

Amidst this dynamic environment, the choice of a mining machine boils down to balancing innovation with practicality. Top manufacturers are rolling out models that integrate AI for automated optimizations, turning what was once a brute-force task into a smart, adaptive process. Whether you’re delving into the foundational world of BTC or exploring the playful realms of DOG and ETH, the key is to stay informed and agile. Hosting your miners at a reputable farm can mitigate risks, offering security and expertise that enhance profitability. In essence, 2025’s blueprint for success is about foresight, diversity, and a dash of audacity—empowering you to navigate the cryptocurrency waves with confidence and flair.

Ultimately, as we wrap up this exploration, remember that choosing profitable Bitcoin mining machines in 2025 is more than a transaction—it’s a commitment to a thriving digital future. By weaving together insights on BTC, ETH, DOG, and the intricacies of mining farms and rigs, you’re not just investing in hardware; you’re betting on the enduring power of blockchain. Stay curious, adapt quickly, and let this blueprint guide you toward rewards that could redefine your financial landscape. The crypto world waits for no one, so gear up, power on, and mine your way to prosperity.

Leave a Reply